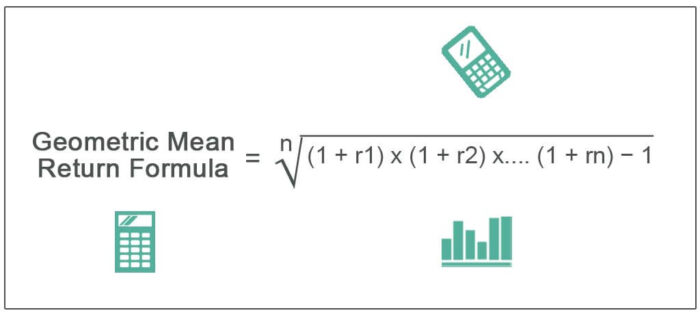

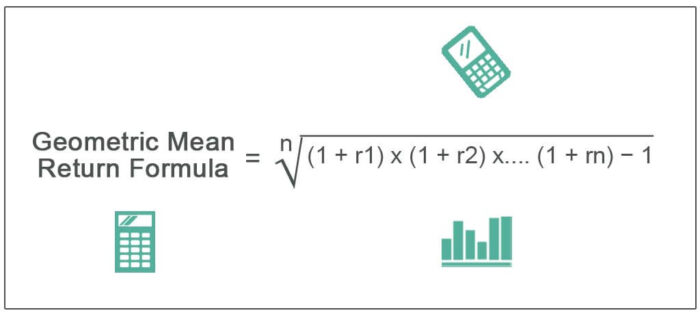

What is the Geometric Mean Return?

The geometric mean return calculates the average return for the investments which are compounded on the basis of its frequency depending on the time period and it is used to analyze the performance of investment as it indicates the return from an investment.

Geometric Mean Return Formula

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Geometric Mean Return (wallstreetmojo.com)

- r = rate of return

- n = number of periods

It is the average set of products technically defined as the ‘n’ th root products of the expected number of periods. The focus of the calculation is to present an ‘apple to apple comparison’ when looking at 2 similar kinds of investment options.

Examples

Let us understand the formula with the help of an example:

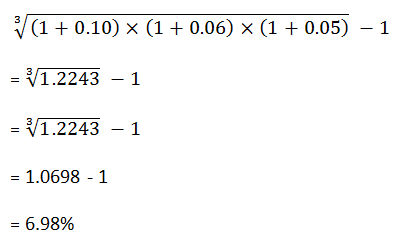

Assuming the return from $1,000 in a money marketMoney MarketThe money market is a financial market wherein short-term assets and open-ended funds are traded between institutions and traders.read more that earns 10% in the first year, 6% in the second year, and 5% in the third year, the Geometric mean return will be:

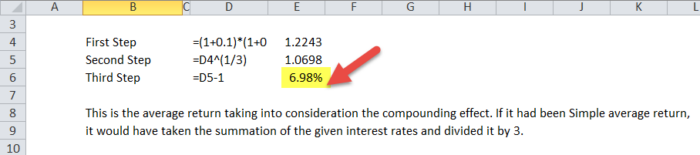

This is the average return taking into consideration the compoundingCompoundingCompounding is a method of investing in which the income generated by an investment is reinvested, and the new principal amount is increased by the amount of income reinvested. Depending on the time period of deposit, interest is added to the principal amount.read more effect. If it had been a Simple average return, it would have taken the summation of the given interest rates and divided it by 3.

Thus to arrive at the value of $1,000 after 3 years, the return will be taken at 6.98% every year.

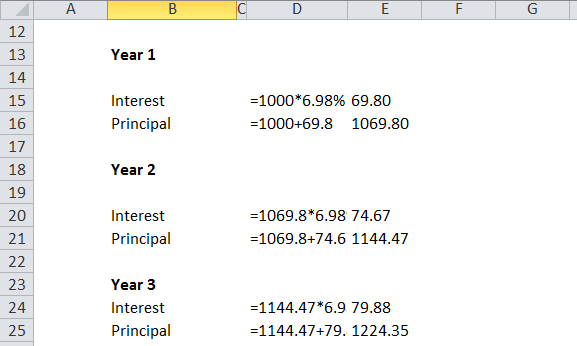

Year 1

- Interest = $1,000 * 6.98% = $69.80

- Principal = $1,000 + $69.80 = $1,069.80

Year 2

- Interest = $1,069.80 * 6.98% = $74.67

- Principal = $1,069.80 + $74.67 = $1,144.47

Year 3

- Interest = $1,144.47 * 6.98% = $79.88

- Principal = $1,144.47 + $79.88 = $1,224.35

- Thus, the final amount after 3 years will be $1,224.35, which will be equal to compounding the principal amount using the three individual interests compounded on a yearly basis.

Let us consider another instance for comparison:

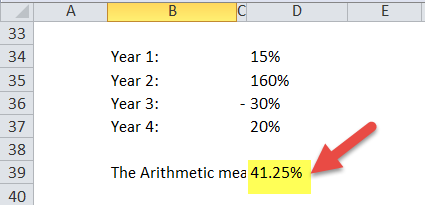

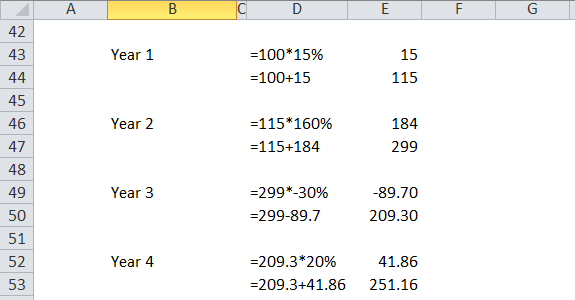

An investor is holding a stock which has been volatile with returns significantly varying from one year to another. The initial investment was $100 in stock A, and it returned the following:

Year 1: 15%

Year 2: 160%

Year 3: -30%

Year 4: 20%

- The Arithmetic mean will be = [15 + 160 – 30 + 20] / 4 = 165/4 = 41.25%

However, the true return will be:

- Year 1 = $100 * 15% [1.15] = $15 = 100+15 = $115

- Year 2 = $115 * 160% [2.60] = $184 = 115+184 = $299

- Year 3 = $299 * -30% [0.70] = $89.70 = 299 – 89.70 = $209.30

- Year 4 = $209.30 * 20% [1.20] = $41.86 = 209.30 + 41.86 = $251.16

The resultant geometric mean, in this case, will be 25.90%. This is much lower than the Arithmetic mean of 41.25%

The issue with Arithmetic mean is that it tends to overstate the actual average return by a significant amount. In the above example, it was observed that in the second xyear the returns had risen by 160% and then fell by 30% which is year over year variance by 190%.

Thus, Arithmetic meanArithmetic MeanArithmetic mean denotes the average of all the observations of a data series. It is the aggregate of all the values in a data set divided by the total count of the observations.read more is easy to use and calculate and can be useful when trying to find the average for various components. However, it is an inappropriate metric to use for determining the actual average return on investment. The geometric meanGeometric MeanGeometric Mean (GM) is a central tendency method that determines the power average of a growth series data. read more is highly useful for measuring the performance of a portfolio.

Uses

The uses and benefits of the Geometric Mean Return formula are:

- This return is specifically used for investments that are compounded. A simple interestSimple InterestSimple interest (SI) refers to the percentage of interest charged or yielded on the principal sum for a specific period.read more account will make use of the Arithmetic average for simplification.

- It can be used for breaking down the effective rate per holding period returnHolding Period ReturnHolding period return refers to total returns over the period for which an investment was held, usually expressed in percentage of initial investment, and for comparing returns from various investments held for different periods of time.read more.

- It is used for Present value and future valueFuture ValueThe Future Value (FV) formula is a financial terminology used to calculate cash flow value at a futuristic date compared to the original receipt. The objective of the FV equation is to determine the future value of a prospective investment and whether the returns yield sufficient returns to factor in the time value of money.read more cash flow formulas.

Geometric Mean Return Calculator

You can use the following Calculator.

| r1 (%) | |

| r2 (%) | |

| r3 (%) | |

| Geometric Mean Return Formula = | |

| Geometric Mean Return Formula = 3√(1 + r1) * (1 + r2) * (1 + r3) − 1 = |

| 3√(1 + 0) * (1 + 0) * (1 + 0) − 1 = 0 |

Geometric Mean Return Formula in Excel (with excel template)

Let us now do the same example above in Excel. This is very simple. You need to provide the two inputs of Rate of Numbers and Number of Periods.

You can easily calculate the Geometric Mean in the template provided.

Thus to arrive at the value of $1,000 after 3 years, the return will be taken at 6.98% every year.

Thus, the final amount after 3 years will be $1,224.35, which will be equal to compounding the principal amount using the 3 individual interests compounded on a yearly basis.

Let us consider another instance for comparison:

However, the true return will be:

The resultant geometric mean, in this case, will be 25.90%. This is much lower than the Arithmetic mean of 41.25%

Recommended Articles

This article has been a guide to Geometric Mean and its definition. Here we discuss the formula of Geometric Mean Return along with examples and excel templates. You may also have a look at these articles below to learn more about Corporate Finance.

- Compare – Geometric Mean vs. Arithmetic MeanCompare – Geometric Mean Vs. Arithmetic MeanGeometric mean is the calculation of mean or average of a series of product values that takes into account the effect of compounding and is used to determine investment performance, whereas arithmetic mean is the calculation of mean by sum of total of values divided by number of values.read more

- Harmonic Mean Example

- Population Mean Formula – ExamplesPopulation Mean Formula – ExamplesThe population mean is the mean or average of all values in the given population and is calculated by the sum of all values in population denoted by the summation of X divided by the number of values in population which is denoted by N.read more

- Weighted Mean FormulaWeighted Mean FormulaThe Weighted Mean equation is a statistical method determining the average by multiplying the weights with their respective mean and taking its sum. It is an average in which weights are assigned to individual values determining each observation’s relative importance. Weighted Mean = ∑ni=1 (xi*wi)/∑ni=1wi read more