What is Doubling Time?

Doubling time refers to the time period required to double the value or size of investment, population, inflation etc and is calculated by dividing the log of 2 by the product of number of compounding per year and the natural log of one plus the rate of periodic return.

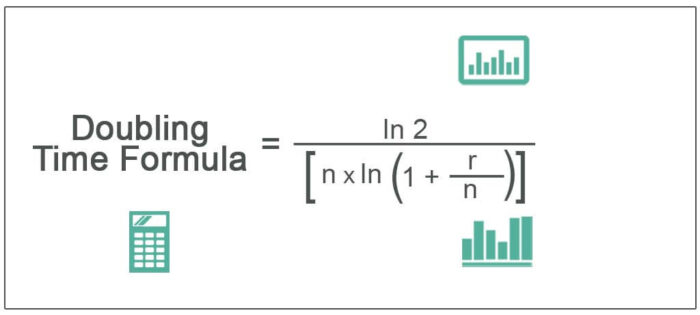

Doubling Time Formula

Mathematically, the doubling time formula is represented as,

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Doubling Time Formula (wallstreetmojo.com)

where

- r = rate of annual return

- n = no. of compounding period per year

In the case of continuous compounding formulaContinuous Compounding FormulaThe continuous compounding formula depicts the interest received when constant compounding is done for an infinite number of periods. The four variables used for its computation are the principal amount, time, interest rate and the number of the compounding period.read more, the calculation of doubling time in terms of years is derived by dividing the natural log of 2 by the rate of annual return (since (1 + r/n) ~ er/n).

Doubling time = ln 2 / [n * ln er/n]

- = ln 2 / [n * r / n]

- = ln 2 / r

where r = rate of return

The above formula can be further expanded as,

Doubling time = 0.69 / r = 69 / r% which is known as rule of 69Rule Of 69The Rule of 69 is a common rule for estimating the time it will take to double an investment with a continuous compounding interest rate. It does not provide an exact time, but it does provide a near approximation without relying on a mathematical formula.read more.

However, the above formula is also modified as the rule of 72The Rule Of 72Rule of 72 is an estimated approach of calculating the time required to double the invested amount at a fixed interest rate. This is determined as a ratio of 72 to the annual interest rate. read more because practically continuous compounding is not used, and hence 72 gives a more realistic value of the time period for less frequent compounding intervals. On the other hand, there is also the rule of 70Rule Of 70The “Rule of 70” refers to the total time it takes to double a quantity or value. It simply means how long it will take to double the money, investments, or profit assuming all other factors remain constant.read more in vogue, which is used just for the ease of calculation.

Doubling Time Calculation (Step by Step)

Follow the below steps:

- Firstly, determine the rate of annual return for the given investment. The annual rate of interest is denoted by ‘r.’

- Next, try to figure out the frequency of compounding per year, which can be 1, 2, 4, etc., corresponding to annual compounding, half-yearly, and quarterly, respectively. The number of compounding periods per year is denoted by ‘n.’ (The step is not required for continuous compounding)

- Next, the rate of periodic return is calculated by dividing the rate of annual return by the number of compounding periods per year. Rate of periodic return = r / n

- Finally, in case of discrete compounding, the formula in terms of years is calculated by dividing the natural log of 2 by the product of no. of compounding period per year and the natural log of one plus the rate of periodic return as Doubling time = ln 2 / [n * ln (1 + r/n)]

- On the other hand, in the case of continuous compounding, the formula in terms of years is derived by dividing the natural log of 2 by the rate of annual return as,

Doubling time = ln 2 / r

Example

Let us take an example where the rate of annual return is 10%. Calculate the doubling time for the following compounding period:

- Daily

- Monthly

- Quarterly

- Half Yearly

- Annual

- Continuous

Given, Rate of annual return, r = 10%

#1 – Daily Compounding

Since daily compounding, therefore n = 365

Doubling time = ln 2 / [n * ln (1 + r/n)]

- = ln 2 / [365 * ln (1 + 10%/365)

- = 6.9324 years

#2 – Monthly Compounding

Since monthly compounding, therefore n = 12

Doubling time = ln 2 / [n * ln (1 + r/n)]

- = ln 2 / [12 * ln (1 + 10%/12)

- = 6.9603 years

#3 – Quarterly Compounding

Since quarterly compounding, therefore n = 4

Doubling time = ln 2 / [n * ln (1 + r/n)]

- = ln 2 / [4 * ln (1 + 10%/4)

- = 7.0178 years

#4 – Half Yearly Compounding

Since half yearly compounding, therefore n = 2

Doubling time = ln 2 / [n * ln (1 + r/n)]

- = ln 2 / [2 * ln (1 + 10%/2)

- = 7.1033 years

#5 – Annual Compounding

Since annual compounding, therefore n = 1,

Doubling time = ln 2 / [n * ln (1 + r/n)]

- = ln 2 / [1 * ln (1 + 10%/1)

- = 7.2725 years

#6 – Continuous Compounding

Since continuous compounding,

Doubling time = ln 2 / r

- = ln 2 / 10%

- = 6.9315 years

Therefore, the calculation for various compounding periods will be –

The above example shows that the doubling time depends not only on the rate of annual return of the investment but also on no. of compounding periods per year and it increases with the increase in the frequency of compounding per year.

Relevance and Use

It is important that an investment analyst understands the concept of doubling time because it helps them to roughly estimate how many years it will take for the investment to double in value. Investors, on the other hand, use this metric to evaluate various investments or the growth rate for a retirement portfolio. In fact, it finds application in the estimation of how long a country would take to double its real gross domestic product (GDP).

Recommended Articles

This article has been a guide to Doubling Time and its meaning. Here we learn the formula to calculate doubling time for different compounding periods along with some practical examples along with downloadable excel templates. You may learn more about excel modeling from the following articles –

- FormulaFormulaMonthly compound interest refers to the compounding of interest every month, which implies that the compounding interest is charged both on the principal and the accumulated interest.read more of Monthly Compound Interest Of Monthly Compound InterestMonthly compound interest refers to the compounding of interest every month, which implies that the compounding interest is charged both on the principal and the accumulated interest.read more

- Daily Compound InterestDaily Compound InterestDaily Compound Interest refers to the total interest amount, including the amount of interest earned on the initial principal & the amount of interest earned daily. It might be higher than Monthly or Quarterly Compound Interest due to the high compounding frequency. read more

- Effective Annual Rate FormulaEffective Annual Rate FormulaThe effective interest rate is the actual rate of interest earned or paid after compounding. It is determined as: Effective Annual Rate Formula = (1 + r/n)n – 1read more

- TVM DefinitionTVM DefinitionThe Time Value of Money (TVM) principle states that money received in the present is of higher worth than money received in the future because money received now can be invested and used to generate cash flows to the enterprise in the future in the form of interest or from future investment appreciation and reinvestment.read more