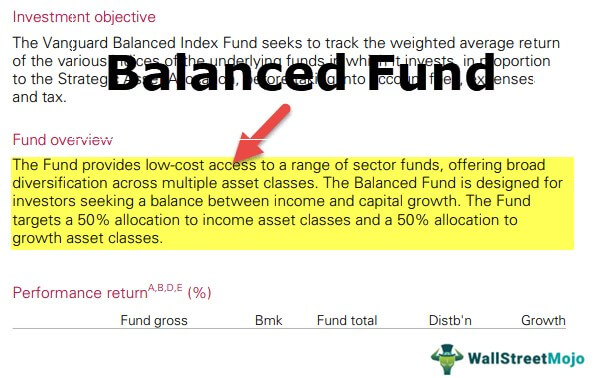

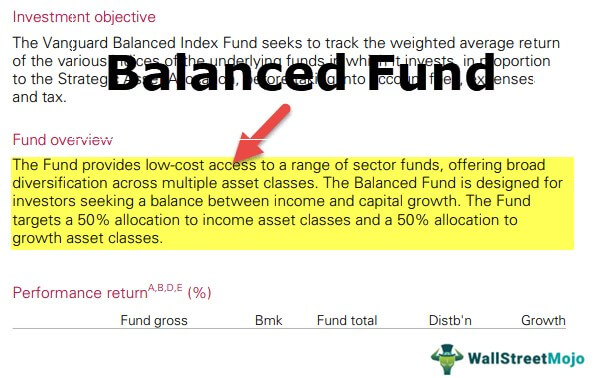

Balanced Funds Meaning

Balanced Funds are the funds that invest the money in the mix of both stocks and bonds intending to achieve a high rate of return on the funds along with balancing the risk with the help of diversification. These funds generally have more risk when compared with the fixed income funds but less risk when compared with the pure equity funds.

In India, balanced funds generally have 30%-40% of their investment in Equity and the remaining in BondsBondsBonds refer to the debt instruments issued by governments or corporations to acquire investors’ funds for a certain period.read more and (or) other debt investment instruments. These funds, like others, are also impacted by the movements in the stock markets as a specific portion is equity-oriented. However, the values of these funds as a whole are to be less volatile in comparison to a 100% equity fund.

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Balanced Funds (wallstreetmojo.com)

Balance Funds Suitability

It is an ideal option of investment primarily for investors who are either

- looking for a stable and steady return with a mid-term investment holding/return gain period (say five years)

- new entrants to the investor’s group with no or limited investment knowledge

- looking for diversification in investment avenues

- Requires to withdraw while maintaining investment.

It would not be an ideal option of investment primarily for investors who are either.

- Willing to take or can manage higher risk

- Looking for a high return for their investments

- Looking to invest in a specific choice of fund since the selection of funds remains with the fund manager.

Examples

Mr.Raj wishes to invest a sum of Rs.1,00,000

Suppose Raj is a less risk takerRisk TakerRisk takers are investors seeking opportunities in the market volatility and risk a great deal in expectation of a high rate of return. Thus, they tend towards high-risk investments with a great potential for returns or a loss at the same time.read more and isn’t willing to take a high risk with his investment choice. He might hold a diversified investmentDiversified InvestmentA diversified portfolio of investments is a low-risk investment plan that works as the best defence mechanism against financial crises. It allows an investor to earn the highest possible returns by making investments in a mixture of assets like stocks, commodities, fixed income.read more portfolio as per the below table.

| Investment Avenues | Investment % | Average Return % | Investment Value | Average Return |

|---|---|---|---|---|

| Government Bonds | 55% | 2.50% | 55,000 | 1,375 |

| Corporate Bonds | 30% | 4.00% | 30,000 | 1,200 |

| Equity | 15% | 18% | 15,000 | 2,700 |

| Total | 100% | 8.17% | 1,00,000 | 5,275 |

Debt Oriented Fund

Suppose Raj is a risk-taker and is willing to take a high risk with his investment choice. He might hold a diversified investmentDiversified InvestmentA diversified portfolio of investments is a low-risk investment plan that works as the best defence mechanism against financial crises. It allows an investor to earn the highest possible returns by making investments in a mixture of assets like stocks, commodities, fixed income.read more portfolio as per the below table.

| Investment Avenues | Investment % | Average Return % | Investment Value | Average Return |

|---|---|---|---|---|

| Tech Stocks | 25% | 18% | 25,000 | 4,500 |

| Pharma Stocks | 25% | 16% | 25,000 | 4,000 |

| Telecom Stocks | 25% | 17.50% | 25,000 | 4,375 |

| Government Bonds | 15% | 2.50% | 15,000 | 375 |

| Corporate Bonds | 10% | 4.00% | 10,000 | 400 |

| Total | 100% | 13.50% | 1,00,000 | 13,250 |

Equity Oriented Fund

An investor must always be thoughtful and remember that their investment in balanced funds is not always protected from market movements and still bears a risk.

Balanced Fund Taxation Advantage

From the tax point of view, taxation policies are different for equity and debt fundsDebt FundsDebt fund are investments, such as a mutual fund, closed-end fund, ETF, or unit investment trust (UTI), that primarily invest in fixed-income instruments like bonds or other types of a debt security for returns.read more. If an investor holds a balanced fund for fewer than 12 months, it shall be categorized under Short-term, and if it exceeds to have for over 12 months, it shall be classified under Long-term.

| Investment Avenues | < 1 Year | 1 to 3 Years | > 3 Years |

|---|---|---|---|

| Equity / Hybrid / Balanced | 15% | 10% (If gain is more than 1,00,000) | 10% (If gain is more than 1,00,000) |

| Debt | As per income slab | As per income slab | 20% (as pe indexation) |

As per the recent updates, the investment made in debt funds held for more than three years in India will be categorized under the long-term and shall be levied capital gains tax percent cent with indexationIndexationIndexation is a method of adjusting the purchase price of an investment (bonds, debentures, or any other asset class) to account for the effect of inflation over the investment term, lowering the capital gain and reducing taxable income.read more benefit. Any earnings made from short term investmentShort Term InvestmentShort term investments are those financial instruments which can be easily converted into cash in the next three to twelve months and are classified as current assets on the balance sheet. Most companies opt for such investments and park excess cash due to liquidity and solvency reasons.read more on debt investments would be added to the income and taxed as per the income tax slab under which the investor shall come.

The longer you hold to your balanced fund, the better is taxation benefit they provide

Recommended Articles

This has been a guide to what balanced funds are and their meaning. Here we discuss Balanced Funds’ suitability, practical examples, and tax advantages. You can learn more about it from the following articles –

- Sinking Fund Formula

- Bond Sinking Fund Definition

- Index Funds vs Mutual Funds

- Mutual Funds vs ETFs – Which is Better?