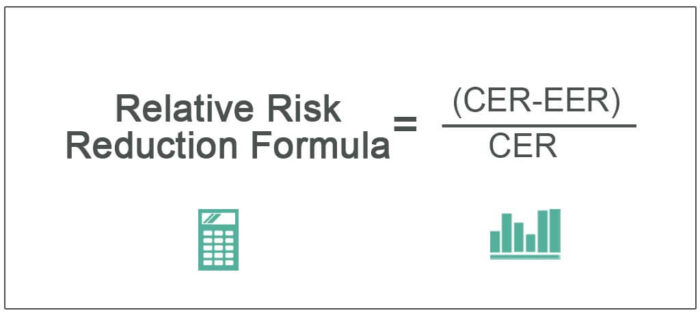

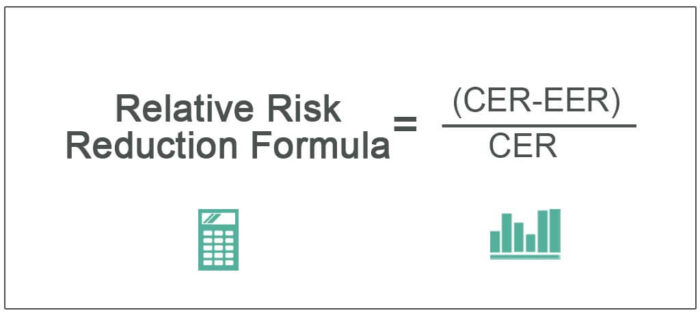

Formula to Calculate Relative Risk Reduction

Relative risk reduction is a relative reduction in the overall business risks due to adverse circumstances of an entity which can be calculated by subtracting the Experimental event rate (EER) from the control event rate (CER) and dividing the resultant with the control event rate (ER).

Relative risk reduction measures risk reduction in the experimental group against the control group, where no risk reduction measures have been used. It is otherwise defined as a reduction in the likelihood of a bad outcome event after experimenting with a solution compared to the control group where no experimental treatment has been provided. The concept of relative risk is more accurate as compared to absolute risk.

In the absolute risk formula, the difference between the lousy outcome between the experimental group and the control group is taken. Still, the total risk formula doesn’t measure the base at which the reduction happened in this formula. It is mainly used in the clinical industry in which, at first, a bad outcome percentage is calculated in a control group. Then in another group called the experiment group, new medicine or treatment is given and determines the rate of a bad outcome. The difference between the wrong result in the experimental group and the control group is relative risk reduction.

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked

For eg:

Source: Relative Risk Reduction Formula (wallstreetmojo.com)

- CER = Event Rate in Control group

- EER = Event Rate in Experiment Group

With this formula, if the RRR is coming to be negative, that means the treatment has increased the risk of the outcome because of EER with greater than CER. On the other hand, if RRR is positive, the risk of the product has been reduced by the treatment, and this treatment can be further checked and applied for approval.

Examples

Example #1

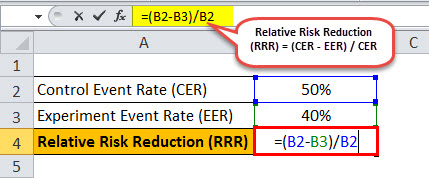

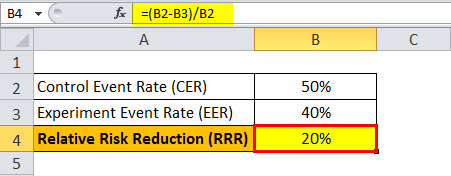

The event rate in the Control Group is 50%, and the event rate in the experiment group is 40%.

Below is given data for the calculation of Relative Risk Reduction.

RRR = (50-40)/50

RRR = 20%

Example #2

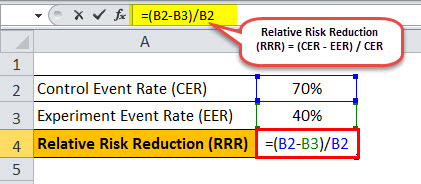

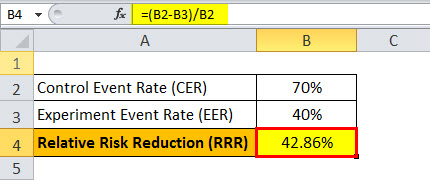

Let’s say scientists have found a new cure for cancer. They want to experiment with a particular group of patients and find out the result of the operations. For the experiment, they have taken two samples of 100 patients each. In one group of patients known as the control group, treatment is provided as usual. With other groups of patients known as the Experimental group, this new treatment is being used. Now patients are observed and are looking for a bad outcome. With the control group in which further treatment has not been provided, the death rate of patients is 70%. But with a new treatment, the death rate got reduced to 40%. With this information, we will find out RRR.

Below is given data for the calculation of Relative Risk Reduction.

RRR calculation = (70-40)/70

RRR = 30/70

RRR will be –

RRR = 42.86%

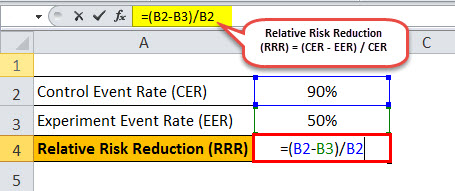

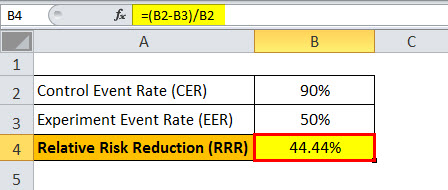

Example #3

Let’s say Pfizer, a leading pharma company in the US has found a treatment by which chances of moving HIV from mother to child would be reduced for a newborn baby. They want to experiment with a particular group of patients and find out the result of the operations. For the experiment, they have taken two samples of 100 patients each. In one group of patients, known as the control group, treatment is provided as usual. With other groups of patients, known as the Experimental group, this new treatment is being used. Now patients are observed and are looking for a bad outcome. With the control group in which further treatment has not been provided, the transfer rate of HIV is 90%. But with the treatment, chances of transfer are reduced to 50%. With this information, we will find out RRR.

The following is data for the calculation of the Relative Risk Reduction of the pharma company.

Relative Risk Reduction Calculation = (90-50)/90

RRR = 40/90

RRR will be –

RRR = 44.44%

Relative Risk Reduction Calculator

You can use the following Relative Risk Reduction Calculator.

| CER | |

| EER | |

| Relative Risk Reduction Formula = | |

| Relative Risk Reduction Formula = |

|

|

Relevance and Uses

The relative Risk Reduction formula is widely used in the medical industry to test the significance of new drugs on patients. It is used to check whether the medicine is useful, and with how much percentage it can reduce the risk of bad outcomes? On the other hand, absolute risk reduction only provides the difference between the harmful effect of the Control group and the Experiment group. So total risk reduction does not provide the info that at what base the risk reduction happened. But the relative risk reduction formula provides that information also because it allows for the percentage change.

So the relative risk reduction formula can be used to compare against different populations with different baseline risks.

Recommended Articles

This has been a guide to the Relative Risk Reduction Formula. Here we discuss how to calculate RRR along with examples and a downloadable excel template. You can learn more about financing from the following articles –

- Check SheetCheck SheetCheck Sheet refers to a type of document that is used for recording data at the time and place of the operation of interest.read more

- Credit Risk DefinitionCredit Risk DefinitionCredit risk is the probability of a loss owing to the borrower’s failure to repay the loan or meet debt obligations. It refers to the possibility that the lender may not receive the debt’s principal and an interest component, resulting in interrupted cash flow and increased cost of collection.read more

- Market Risk Premium FormulaMarket Risk Premium FormulaMarket risk premium refers to the extra return expected by an investor for holding a risky market portfolio instead of risk-free assets. Market risk premium = expected rate of return – risk free rate of returnread more

- Calculate Residual RiskCalculate Residual RiskResidual risk, also known as inherent risk, is the amount that still pertains after all the risks have been calculated. In simple words, this is the risk that is not eliminated by the management at first, and the exposure that remains after all the known risks have been eliminated or factored in.read more